31+ Take Home Pay Calculator Michigan

This free easy to use payroll calculator will calculate your take home pay. Taxpayers can choose either itemized deductions.

Eurodesk Opportunity Finder

Michigan 8000000 Salary Example.

. Well do the math for youall you need to do is. For a married couple with a combined annual income of 110000 the take. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Michigan. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Determine your filing status Step 2. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Michigan. This income tax calculator can help estimate your average.

Just enter the wages tax withholdings and other information required. The take home pay is 4259950 for a single resident in Detroit with an annual income of 55000. How do I figure out how much my paycheck will be.

This Michigan hourly paycheck. Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Net income Adjustments Adjusted gross income Step 3.

The state income tax rate in Michigan is over 4 while federal income tax rates range from 10 to 37 depending on your income. Simply enter their federal and state W-4. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022.

Supports hourly salary income and multiple pay frequencies. This 8000000 Salary Example for Michigan is based on a single filer with an annual salary of 8000000 filing their 2023 tax return in Michigan in. Michigan Salary Calculator for 2023 The Michigan Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates.

2021 22 Welch College Academic Catalog By Welch College Issuu

117 Osprey Avenue Roscommon Mi 48653 201816530 Re Max Of Michigan

Mls 201822393 209 Chippewa Trail Prudenville Mi 48651

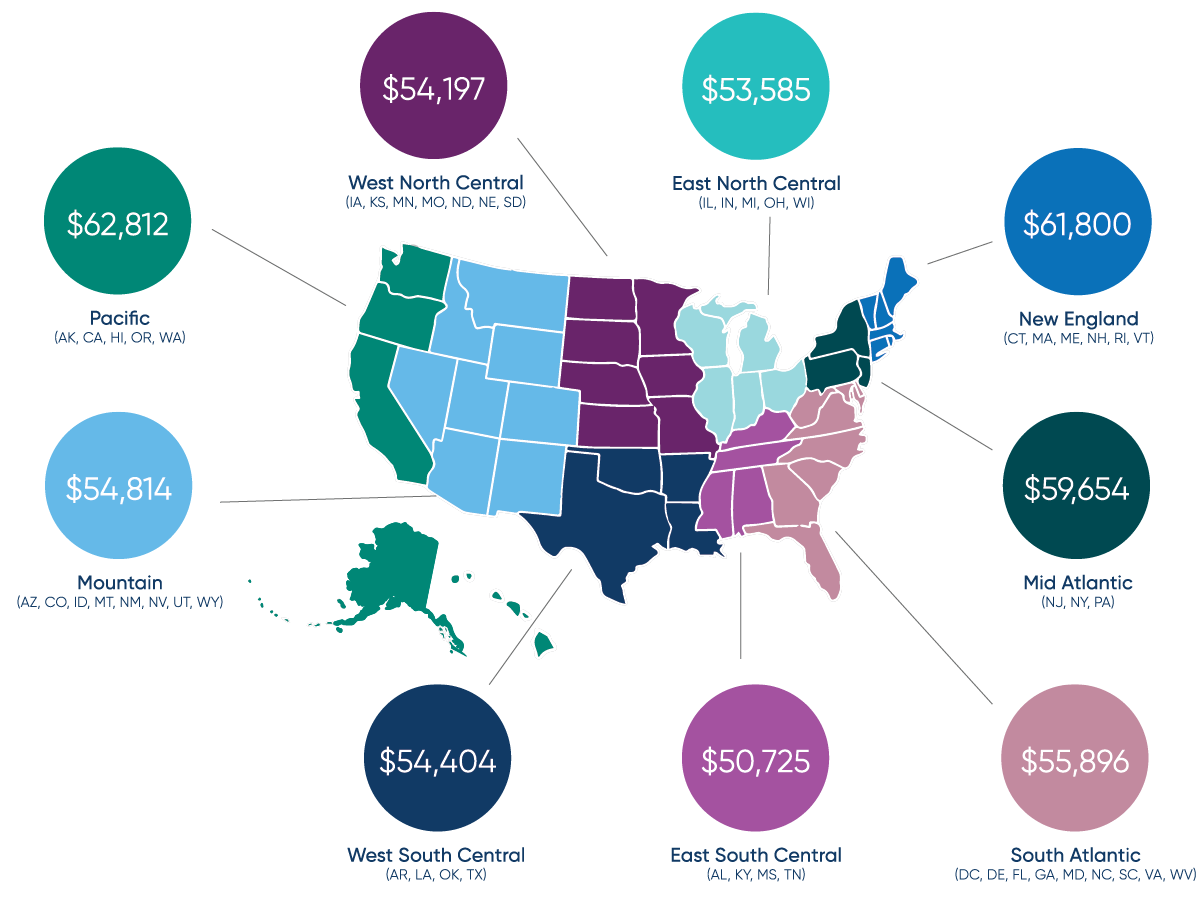

Medical Coding Salary Medical Billing And Coding Salary Aapc

6520 College Hill Road Clinton Ny 13323 Compass

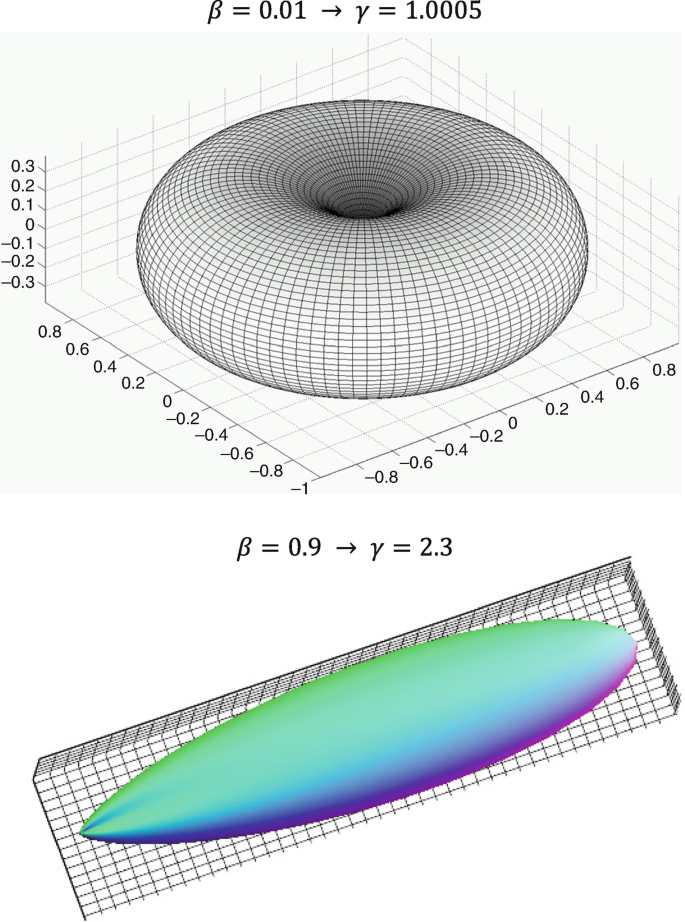

Application Of Accelerators And Storage Rings Springerlink

Michigan Salary Paycheck Calculator Gusto

491 Oxford Rd Grosse Pointe Woods Mi 48236 Mls 20221055564 Redfin

Medical Coding Salary Medical Billing And Coding Salary Aapc

Lafayette Park Place Detroit Mi Apartments 1387 E Larned St Detroit Mi Rentcafe

491 Oxford Rd Grosse Pointe Woods Mi 48236 Mls 20221055564 Redfin

Paycheck Calculator Take Home Pay Calculator

364 W Huron Ave Rogers City Mi 49779 Mls 201821905 Zillow

Michigan Lottery Tax Calculator Comparethelotto Com

4 Invoice Examples For Medical Record Requests Etactics

1145 Elizabeth Rd Alpena Mi 49707 Realtor Com

Sacrifices Saving 50 Of Take Home Pay Bogleheads Org